How to Use Credit Card Points for Travel: A Beginner’s Guide to Flexible Rewards

Credit Card Points Changed How We Travel

For years, we relied on my husband’s Hilton points from work trips to cover a few free nights at Embassy Suites or Hampton Inn. It was fun while it lasted… until we hit a wall. We were stuck with one hotel chain, and those “free” nights didn’t stretch very far.

That’s when I discovered flexible credit card points — the kind you can move around to different airlines and hotels. Spoiler: they’re the game-changer that makes points worth paying attention to.

What’s the point? ⚡ You’ll see!

What Are Flexible Credit Card Points?

Flexible credit card points (also called transferable points) are a type of credit card reward that gives you more control over how you use your points.

Unlike points tied to a specific airline or hotel, like Delta SkyMiles or Marriott Bonvoy, flexible points can be transferred to a variety of airline and hotel partners. Think of them as a central hub for your travel rewards: you earn in one place, then later decide where to send them based on your plans.

That means you can earn points from everyday spending and later decide how to use them: for flights, hotels, or other travel.

One way to use your points is through your card’s travel portal, or with Capital One, you can even erase eligible travel purchases. These options are easy, flexible, and can absolutely give you more value than if you were paying cash, especially for budget flights, hotels, or last-minute bookings. For some travelers, they’re the perfect fit.

Why Flexible Points Are the Secret Sauce

Most beginners start with non-flexible points, like Delta SkyMiles from a Delta card or Hilton Honors points from a Hilton card. These are great, but they lock you in. You can’t move them elsewhere, so you’re limited.

Flexible points, on the other hand, are your superpower. They can:– Transfer to multiple airline and hotel partners.

– Be used through your card’s travel portal (like Chase or AmEx).

– Sometimes even cover travel purchases outright (Capital One’s “travel eraser” feature).

The magic here is choice, but more than that, it’s strategy. Knowing when and how to use these points is what turns them into your travel “secret sauce”.

Flexible Points vs. Non-Flexible Points

| Feature | Non-Flexible Points | Flexible Points |

|---|

| Tied to brand | Yes (United, Marriott) | No – can be moved to many partners |

| Value options | Limited | Multiple ways to redeem |

| Best for | Loyal travelers to one brand | Beginners who want freedom + max value |

Co-Branded Cards vs. Flexible Points Cards

Co-Branded Cards

Cards like the (American Express) Delta cards or the (Chase) Hyatt cards earn points or miles within those specific loyalty programs. They offer non-transferable/non-flexible points.

✈️🤝🏨 Co-branded cards still play an important role in the points and miles world, especially for benefits like elite status, companion tickets, or annual free nights. But in this post, we’re sticking with flexible points because of their ability to stretch across multiple programs and open more options when you’re ready to book.

Flexible Points Cards

These earn rewards inside the bank’s flexible rewards program. You can keep the points there, transfer them to travel partners, or use them in other ways.

Transferable and non-transferable points from co-branded and flexible points cards can all be used in harmony, thereby increasing your options for earning.

Top Programs Offering Transferable Points

- Chase Ultimate Rewards

- Top Cards: Sapphire Preferred, Sapphire Reserve, Ink Business cards

- American Express Membership Rewards

- Top Cards: AmEx Gold, Platinum, Blue Business Plus.

- Citi ThankYou Points

- Top Cards: Citi Strata Premier, Strata Elite.

- Capital One Miles

- Top Cards: Venture X, Venture Rewards.

Other Programs

- Wells Fargo Points Transfer Program

- Top cards: Autograph, Autograph Journey

- Bilt Rewards (Supported by Wells Fargo, but with it’s own program and transfer partners)

- Unique: Earn points on rent payments with the Bilt Mastercard.

- Mesa (Homeowners Card)

- Unique: Earn points on mortgage payments (read the fine print)

- Rove Miles (Shopping portal that earns transferable points)

- Unique: Earn points on gift cards; Rove miles earned from flights, hotels, or shopping can be transferred to airline and hotels partners.

Why Flexible Points Are Better for Travel

1. You Can Transfer Points to Travel Partners

Transferable points allow you to build a pool of points and send them to different hotel and airline partners. Want to use some points for a Hyatt stay and the rest for a United flight? No problem. You can divide and transfer points based on your travel plans.

When you transfer points, they move into an airline or hotel’s loyalty program, and they combine with whatever points you already have there. So if you flew United once and earned a few miles that are sitting in your United account, you’re not stuck. If you have Chase Ultimate Rewards, you can transfer just enough points to United to top off your balance. Once they land in your United account, they’re treated the same as your original miles, ready to book your next flight through the United website.

For example:

- With Citi Thank You Points, you can transfer points to Choice Privileges for a hotel stay and/or to Air France Flying Blue for a flight.

- Combining points from multiple programs (e.g., Chase and Capital One) to a shared partner like Virgin Atlantic can help you utilize your points and miles to their maximum value.

2. You Can Get More Value Per Point

Bank travel portals often offer a fixed value for each point. If you know where or HOW to look, you can often find much better redemptions with the partners directly. Below, I will show you some great examples of how transferring your points and booking through partners can provide far outsized value.

3. You Get More Options

In addition, each rewards program has a unique set of transfer partners, allowing you to tailor your redemptions to your travel needs.

Tip: Search one-way awards and be flexible on dates. Transfer only when you’re ready to book, since moves are usually irreversible.

Programs & Transfer Partners: Where You Can Move Your Points

Partner lineups change so always check the latest transfer partners in your bank portal.

Chase Ultimate Rewards

- Airlines: United Airlines, Southwest, JetBlue, Virgin Atlantic, Emirates, Air Canada (Aeroplan), Air France-KLM (Flying Blue), British Airways, Iberia, Aer Lingus, and Singapore Airlines.

- Hotels: Hyatt, Marriott Bonvoy, IHG Rewards.

American Express Membership Rewards

- Airlines: Delta, Virgin Atlantic, Emirates, Air France-KLM (Flying Blue), British Airways, Iberia, Aer Lingus, Singapore Airlines, ANA, Qantas, Cathay Pacific, Etihad, Avianca, Aeromexico, and more.

- Hotels: Hilton, Marriott Bonvoy, Choice Privileges.

Capital One Miles

- Airlines: Air Canada (Aeroplan), Avianca, British Airways, Air France-KLM (Flying Blue), Emirates, Etihad, Singapore Airlines, Turkish Airlines, TAP Air Portugal, Qantas, and others.

- Hotels: Wyndham, Choice Privileges, Accor.

Citi ThankYou Points

- Airlines: Air France-KLM (Flying Blue), Avianca, Turkish Airlines, Qantas, Qatar Airways, Emirates, Singapore Airlines, Etihad, EVA Air, and others. (and now, Citi is the only partner that allow transfers to American Airlines!)

- Hotels: Choice Privileges, Wyndham.

Wells Fargo Rewards

- Airlines: Aer Lingus, Air France-KLM Flying Blue, Avianca Lifemiles, British Airways Executive Club, Iberia, Virgin Atlantic

- Hotels: Choice Privileges

Bilt Rewards

- Airlines: Alaska Airlines, United Airlines, Air France-KLM (Flying Blue), Emirates, Cathay Pacific, Turkish Airlines, and more.

- Hotels: Hyatt, IHG Rewards, and Wyndham.

Mesa

- Airlines: Aeromexico, Air Canada (Aeroplan), Cathay Pacific, Thai Airways, and more.

- Hotels: Accor Live Limitless (only hotel partner)

Rove Miles

- Airlines: Aeromexico, Cathay Pacific, Etihad, Finnair, Air France-KLM (Flying Blue), Qatar Airways, Thai Airways, Turkish Miles & Smiles, Vietnam Airways

- Hotels: Accor Live Limitless (only hotel partner)

Overlapping Transfer Partners

Some programs share common partners, thus making it easier to combine points from different banks toward a single loyalty program.

- Air France-KLM Flying Blue: Available with Chase, AmEx, Capital One, Citi, Wells Fargo, and Bilt.

- British Airways Avios: Available with Chase, AmEx, Capital One, Citi, Bilt, and Wells Fargo.

- Singapore Airlines KrisFlyer: Available with Chase, AmEx, Capital One, Citi, Wells Fargo.

- Emirates Skywards: Available with AmEx, Capital One, Citi, and Bilt. (Emirates no longer a Chase transfer partner as of Oct 2025)

- Virgin Atlantic: Available with Chase, AmEx, Capital One, Citi, and Bilt.

Beginner’s Shortcut: Easiest Transfer Partners to Start

🧭

New to this? Don’t worry about memorizing every airline and hotel program. If you just remember these three, you’ll already unlock outsized value:

Hyatt (via Chase) — Amazing hotel redemptions, often half the points compared to portals.

United Airlines (via Chase or Bilt) — Easy to book domestic and international flights.

Air France-KLM Flying Blue (via Chase, AmEx, Capital One, Citi, Wells Fargo, Bilt) — A sweet spot for flights to Europe.

Learn these, and you’ll have a strong starting toolkit without drowning in partner charts.

How to Transfer Credit Card Points

Each credit card program lets you transfer points to its travel partners right from your online account in the same place you go to check transactions, pay your bill, and manage your card. Every program looks a little different, but you’ll always want to find the section labeled something like “Rewards,” “Points,” or “Travel”.

Useful Transfer Links for Rewards Programs

American Express Membership Rewards

Transfer Ratios

Many points transfer from their respective bank program to the loyalty account point for point (1:1 ratio), but some have a slightly different transfer ratio. For example, Hilton transfers from American Express to Hilton at a 1:2 ratio, meaning for every American Express point you transfer to Hilton, you will get 2 Hilton points.

Transfer Bonuses

Often, bank rewards programs will offer promotions where they will include a transfer bonus if you transfer your points to a specified partner. For example:

Chase may offer a 20% transfer bonus to Aeroplan. That means for every 1000 points you transfer from Chase to Aeroplan, you will get an extra 200 points in your Aeroplan account.

How to Earn Transferable Points

1. Sign-Up Bonuses

Earn a significant chunk of points by meeting the spending requirements after opening a card. For example:

- Spend $4,000 in 3 months and earn 60,000 points.

2. Category Bonuses

Some cards offer bonus points for specific categories like dining, travel, or groceries.

3. Referral Bonuses

Invite friends to apply for a card and earn bonus points when they’re approved.

4. Shopping Portals

Earn extra points by shopping through an online portal that earns transferable or non-transferable points. For example:

- Bank Portals

- Hotel and Airline Portals

- Third-Party Portals

Strategies for Maximizing Value in the way that fits YOU

Start with your goals. Luxury flights? AmEx shines. Hotel stays? Chase + Hyatt is gold.

Don’t hoard forever. Programs devalue. Earn, plan, redeem.

Mix it up. Co-branded cards + flexible points work great together.

Test newer programs (like Rove). Potential is there, just expect quirks.

Example 1: Hotels and Resorts

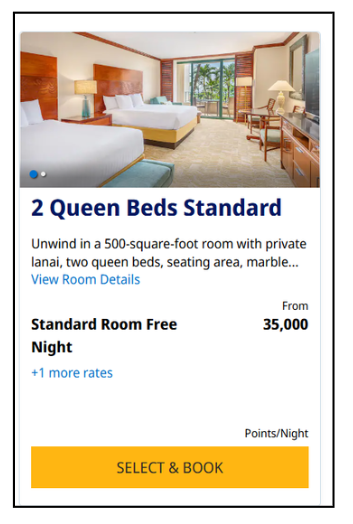

Grand Hyatt Kauai, Hawaii

The Grand Hyatt Kauai is an award category 7 resort. Hyatt is a transfer partner of Chase so you can use Chase Ultimate Rewards to pay for your stay. Here is an example of the cost in both cash and points when booked via the Chase travel portal and the Hyatt website. This example uses the same date (February 17-18, 2025) for a one night stay in a standard 2 Queen room.

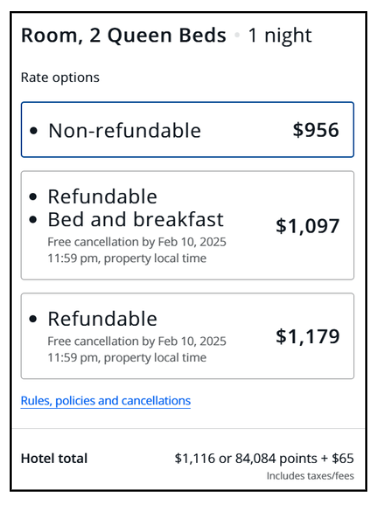

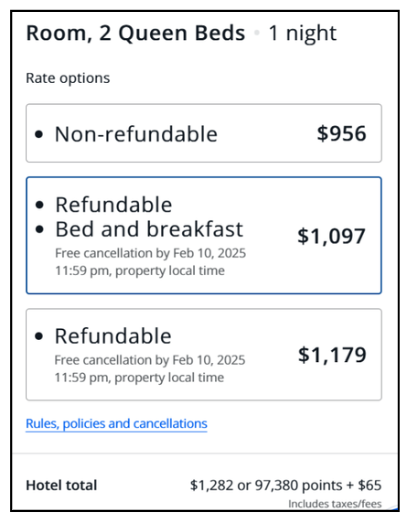

Booking in the Chase Travel Portal:

Cash

Non-refundable: $1,116

Refundable and Breakfast Included: $1,282

Points

Non-refundable: 84,084 plus $65 (taxes and fees)

Refundable and Breakfast Included: 97,380 plus $65 (taxes and fees)

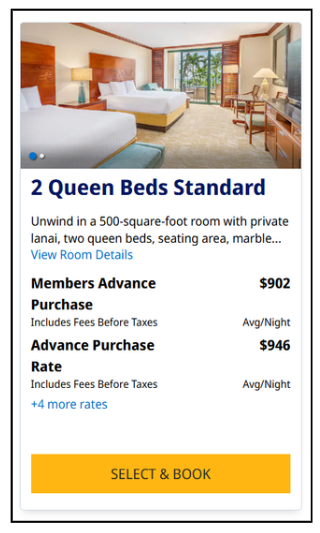

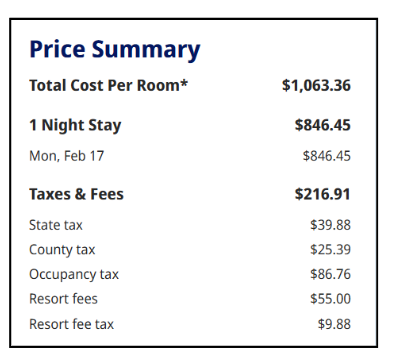

Transferring Chase Points to Hyatt and Booking via the Hyatt Website:

Cash $1,063.36

Points: 35,000

To recap, here are the different ways you can book and the prices that correspond with those methods of booking:

- Chase Travel Portal:

Points: minimum of 84,084 Chase points plus $65 taxes and fees

Cash: $1,116 in cash (non-refundable option)

- Chase Ultimate Reward Points Transferred to Hyatt and Booked via Hyatt

Hyatt Points: 35,000 points

Cash: $1,063

Key Differences Between Booking Methods

Booking Directly with Hyatt Using Hyatt Points

- Flexible Cancellation Policies:

- You’ll typically receive a full refund of your points if you cancel at least 48 hours before your stay. However, always check the specific cancellation policy for your chosen property.

- No Additional Fees:

- Hyatt bookings using points don’t incur taxes, fees, or resort fees.

- Breakfast and Perks:

- Breakfast is not automatically included unless:

- You hold elite status with Hyatt.

- You book a specific room type that includes breakfast (requires more points).

- Breakfast is not automatically included unless:

Booking via Chase Travel Portal

- Higher point cost compared to transferring points.

- Taxes and fees are an additional expense.

- You must pay for more flexibility for cancellations and refunds.

See how much your favorite Hyatt property would be in points here.

Example 2: Flights

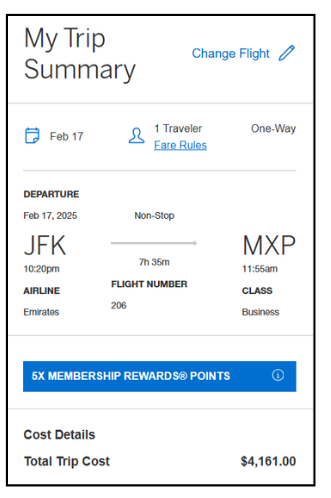

Emirates Business Class (with Lounge Access) to Italy

This exact flight was my very FIRST international business class flight points redemption and it ruined me for all other flights. This flight includes a lie flat comfy seat, plenty of legroom, handy amenity kits, and of course free food and drinks from the lounge to the flight. I even took a private shower in the lounge before I hopped on the plane! This is not the cheapest points redemption, but the value you get from each point is eye-opening.

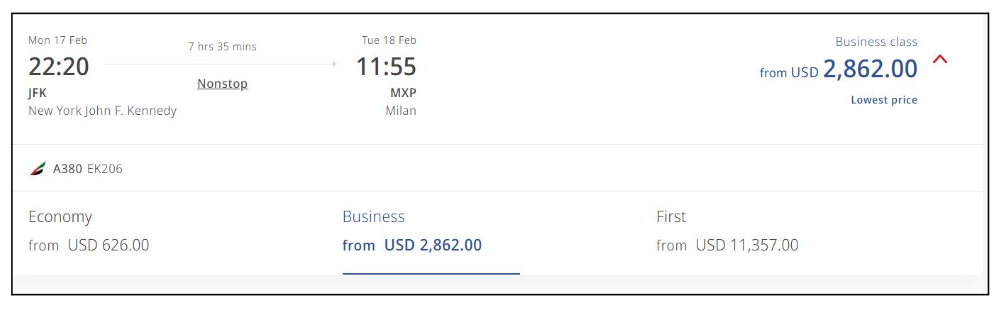

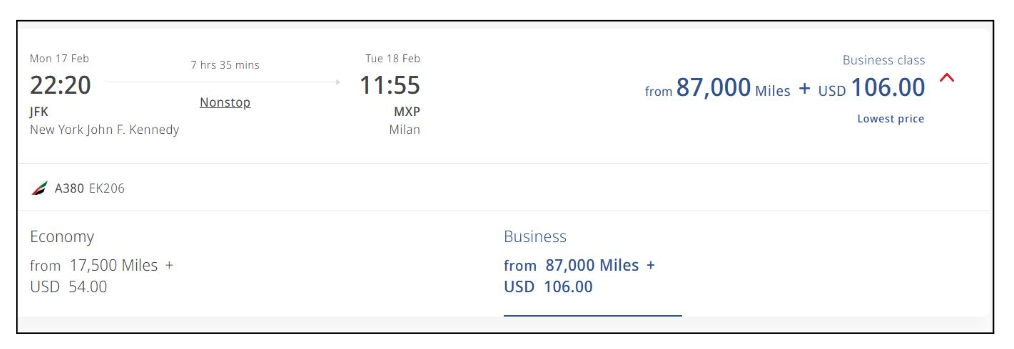

This example uses the same date (February 17-18, 2025) for a one-way business flex flight from JFK to Milan (MXP).

Booking in the American Express Travel Portal:

Cash Price: $4,161.00

Points Price: 416,100

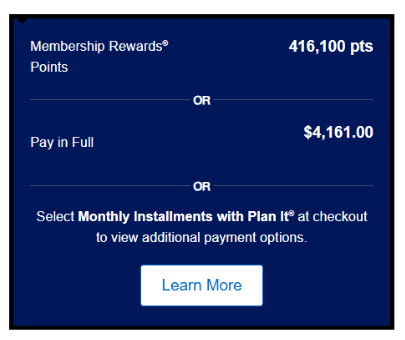

American Express Membership Rewards transferred to Emirates and booked via the Emirates website

Cash value $2862.00

Points: 87,000 plus $106 (taxes and fees)

To recap, here are the different ways you can book and the prices that correspond with those methods of booking:

- American Express Travel Portal

Cash: $4,161.00 or

Points: 416,100

- Transfer AmEx Membership Rewards Points to Emirates and book with Emirates

Cash: $2,862.00

Skywards Miles: 87,000 miles (plus $106)

Want to check out where you can go on Emirates? Check here by clicking “Classic Rewards”.

Why Transferring Is the Game-Changer

As you can see, pricing can vary in cash or points depending on the method of booking. Did you know there could be THIS much of a difference though? People who use points and miles just know to look at all of the different ways to book. Though it isn’t a fast and hard rule, generally the method of transferring pooled bank program points to a hotel or airline chain can get you outsized value. These examples show that, but this same principle doesn’t just apply to expensive or luxury products. You can see this in domestic stays or flights, flights from economy to first class, budget hotels to top of the line.

Packing It Up!

Transferable points have revolutionized the way my family travels. They provide the freedom to choose, the potential for more travel, and the ability to maximize every point earned. Furthermore, by understanding how these programs work, you can turn everyday spending into incredible travel experiences.

So, whether you’re planning a dream vacation or just want to stretch your travel budget further, transferable points are your key to unlocking endless possibilities.

FAQs

Which Transferable Points Program is Best for Beginners?

Chase Ultimate Rewards is often recommended for beginners due to its ease of use, different card options, and variety of travel partners. The program offers a straightforward interface and numerous opportunities to stack points, making it an excellent choice for those new to transferable points.

Are There Any Fees for Transferring Points to Partners?

In most cases, no. However, there is one notable exception: American Express charges a small excise tax offset fee of $0.0006 per point when transferring to domestic airline partners. This fee does not apply to international airlines or hotel partners but is something to consider when planning your redemptions.

What If the Airline I Want to Fly Is Not a Direct Partner of Any Program?

You can still book flights on carriers that are not direct partners through their alliance or codeshare relationships (it’s less complicated than it sounds!) For example, I transferred points to Virgin Atlantic to book a flight on their website, but the actual flight was operated by ITA Airways. Similarly, American Airlines miles can be used to book Japan Airlines flights, even though JAL is not directly connected to bank rewards programs. These “sweet spot” redemptions are one of the best ways to maximize value.

Is Booking Flights with Miles Different from Booking with Cash?

Yes, booking flights with miles is different from booking with cash, and flexibility is key. To find the best value, you often need to search for one-way flights, explore various dates, and focus on specific routes served by partner airlines.

For example, when I booked an Emirates flight to Italy, I knew that Emirates and its partners did not service my home airport (RDU). Instead, I identified a direct Emirates route from JFK to Milan. By searching for this specific route, I easily found and booked the flight. Then, I added a separate positioning flight from RDU to JFK, ensuring enough time to enjoy the Emirates lounge before the long-haul journey to Milan.

Being open to adjustments like these can unlock significant value. To identify partner airline routes and opportunities, a quick Google search or exploring airline alliance networks can provide the information you need.