How to Use Credit Card Points for Travel: A Beginner’s Guide to Flexible Rewards

✈️ Credit Card Points Changed How We Travel

For years, we used Hilton points from my husband’s work trips for a few “free” nights at Embassy Suites. Fun, yes — but limited. We were locked into one hotel chain, and those points didn’t stretch far.

Then I discovered flexible credit card points, the kind you can move between airlines and hotels. Spoiler: they’re a total game-changer.

What’s the point? ⚡ You’ll see!

🏋️ What Are Flexible Credit Card Points?

Flexible (or transferable) credit card points give you freedom — you earn points with one credit card but can move them to different travel partners later.

Think of them as a central hub for travel rewards. You can redeem through:

- Your card’s travel portal

- Direct transfers to airlines or hotels

- Or (with Capital One) by “erasing” travel purchases.

👉 This makes them perfect for anyone wondering how to use credit card points for flights, hotels, or international travel without being locked into one brand.

💵 That means you can earn points from everyday spending and later decide how to use them: for flights, hotels, or other travel.

Why Flexible Credit Card Points Are the Secret Sauce

Most beginners start with co-branded cards — like the Delta SkyMiles or Marriott Bonvoy cards — and they’re a solid way to dip your toes into travel rewards. The catch? You’re tied to one brand, so your points only go so far.

Flexible cards, on the other hand, are like the choose-your-own-adventure version of travel rewards. You can decide later if those points fly you to Paris, pay for a Hyatt stay, or cover a spontaneous weekend trip.

They can:– Transfer to multiple airline and hotel partners.

– Be used through your card’s travel portal (like Chase or AmEx).

– Sometimes even cover travel purchases outright (Capital One’s “travel eraser” feature).

The magic here is choice, but more than that, it’s strategy. Knowing when and how to use these points is what turns them into your travel “secret sauce”.

🤸🏻♀️ Flexible Points vs. Non-Flexible Points

| Feature | Non-Flexible Points | Flexible Points |

|---|---|---|

| Tied to brand | Yes (United, Marriott) | No – move to many partners |

| Redemption options | Limited | Multiple (flights, hotels, travel portals) |

| Best for | Loyal travelers to one brand | Beginners who want freedom + max value |

💳 Co-Branded Cards vs. Flexible Points Cards

Co-Branded Cards

Earn points directly with a brand (e.g., Delta AmEx, Marriott Bonvoy).

Great for loyalty perks like elite status or free nights.

→ Not ideal if you want flexible redemptions.

✈️🤝🏨 Co-branded cards still play an important role in the points and miles world, especially for benefits like elite status, companion tickets, or annual free nights. But in this post, we’re sticking with flexible points because of their ability to stretch across multiple programs and open more options when you’re ready to book.

Flexible Points Cards

Earn in a bank’s system (Chase Ultimate Rewards, AmEx Membership Rewards, etc.), then transfer or redeem however you like.

→ Best for travelers who value choice + maximum redemption potential.

Transferable and non-transferable points from co-branded and flexible points cards can all be used in harmony, thereby increasing your options for earning.

🌍 Top Programs Offering Transferable Points

If you’re new to using credit card points for travel, start with the four main transferable rewards programs.

These are the “core four” that most travelers use — and for good reason.

They’re established, versatile, beginner-friendly, and packed with valuable airline and hotel partners.

🧭 The Core Four: Best Transferable Points Programs for Beginners

💳 Chase Ultimate Rewards

Top Cards: Sapphire Preferred, Sapphire Reserve, Ink Business Preferred

Why It’s Great for Beginners: Easiest for beginners to learn. Transfers to Hyatt, United, and Air Canada Aeroplan. Great travel portal value and strong 1:1 partners.

💳 AmEx Membership Rewards

Top Cards: AmEx Gold, Platinum, Blue Business Plus

Why It’s Great for Beginners: Best for luxury travel and airline redemptions — great for first/business class. Huge transfer list including Delta, ANA, and British Airways.

💳 Citi ThankYou Points

Top Cards: Citi Strata Premier, Strata Elite

Why It’s Great for Beginners: Strong international airline lineup. Great for travelers who book beyond the U.S. and want flexibility across alliances.

💳 Capital One Miles

Top Cards: Venture X, Venture Rewards

Why It’s Great for Beginners: The “hybrid” option. Use miles to “erase” travel charges or transfer to airlines like Turkish, Air France-KLM, or Qantas.

🌿 Beyond the Big Four: Other Transferable Points Programs Worth Knowing

Once you’re comfortable with the core four, you can branch out into other programs that offer unique ways to earn and redeem.

These won’t fit everyone, but they can fill specific gaps — especially if you pay rent, own a home, or like testing new tools.

Bilt Rewards

Top Cards / Platforms: Bilt Mastercard

What Makes It Unique: Earn points on rent payments with no fees. Transfers to Hyatt, United, Alaska, and Flying Blue. Great for renters who want to start earning travel rewards.

Wells Fargo Rewards

Top Cards / Platforms: Autograph and Autograph Journey

What Makes It Unique: Newer to the transferable space. Transfers to Air France-KLM, Virgin Atlantic, and Choice Hotels. Great for diversifying points across banks.

Mesa Rewards

Top Cards / Platforms: Mesa Homeowners Card

What Makes It Unique: Earn points on mortgage payments (yes, really). Transfers to Aeromexico, Cathay Pacific, and Thai Airways. A niche but creative way for homeowners to earn travel rewards.

Rove Miles

Top Cards / Platforms: Rove Shopping Portal

What Makes It Unique: Earn miles from shopping, gift cards, or travel bookings. Transfers to Flying Blue, Qatar Airways, and Accor Hotels. Ideal for maximizing everyday purchases.

✈️ Quick Tip: Which Program Should You Start With?

If your main goal is…

- Free hotel stays: → Go with Chase Ultimate Rewards (Hyatt is unbeatable).

- Premium flights: → AmEx Membership Rewards or Citi ThankYou Points.

- Simple travel redemptions: → Capital One Miles (use or transfer with ease).

- Unique earning opportunities (rent, mortgage, shopping): → Explore Bilt, Mesa, or Rove after you’ve built a foundation.

How to Use Credit Card Points for Flights and Hotels (Step-by-Step)

1. How to Transfer Credit Card Points to Travel Partners

You can move flexible points into partner programs like United, Air France-KLM, Hyatt, etc.

Chase Ultimate Rewards → World of Hyatt for incredible point value

AmEx Membership Rewards → Air France-KLM Flying Blue for affordable flights to Europe.

Citi ThankYou Points → Turkish Airlines Miles & Smiles for premium cabins or Star Alliance partner flights.

Capital One Miles → Air Canada Aeroplan for flights on Air Canada or Star Alliance partners like United and Swiss. Excellent value for both economy and business class — and transfers are 1:1.

➡️ Always transfer only when you’re ready to book. Transfers are usually final, and point values can vary by program.

Why Transfers Matter

Transferring points gives you access to higher-value redemptions, like business class flights or five-star hotels, often for fewer points than you’d need through a bank portal.

2. Get More Value per Point

Booking through a travel portal gives fixed value (e.g., 1.25¢–1.5¢ per point).

Transferring directly to partners often yields 2¢+ per point, especially on premium flights or top hotel redemptions.

Tip: Search one-way awards and be flexible on dates. Transfer only when you’re ready to book, since moves are usually irreversible.

3. Compare Booking Methods

(Scroll for full table if some columns are hidden.)

| Method | Example | Pros | Cons |

|---|---|---|---|

| Bank Travel Portal | Chase Portal, AmEx Travel | Simple, flexible | Higher point cost |

| Transfer to Partner | Hyatt, Emirates | Best value | Requires availability |

| Travel Eraser (Capital One) | Use points after purchase | Quick + easy | Fixed value |

💰 How to Earn Travel Points

- Welcome Bonuses – e.g., “Earn 60,000 points after $4,000 spend in 3 months.”

- Category Spending – Earn bonus points on travel, dining, groceries, etc.

- Referral Bonuses – Invite friends for extra rewards.

- Shopping Portals – Multiply earnings by shopping through partner portals.

Best Transfer Partners for Beginners (Quick Picks)

🧭

New to this? Don’t worry about memorizing every airline and hotel program. If you just remember these three, you’ll already unlock outsized value:

Hyatt (via Chase) — Amazing hotel redemptions, often half the points compared to portals.

United Airlines (via Chase or Bilt) — Easy to book domestic and international flights.

Air France-KLM Flying Blue (via Chase, AmEx, Capital One, Citi, Wells Fargo, Bilt) — A sweet spot for flights to Europe.

Learn these, and you’ll have a strong starting toolkit without drowning in partner charts.

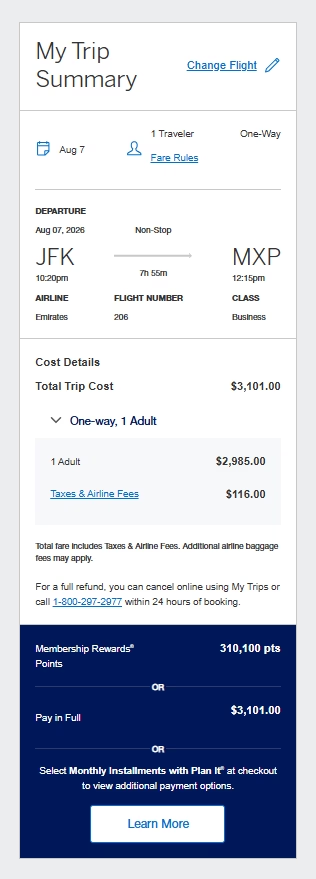

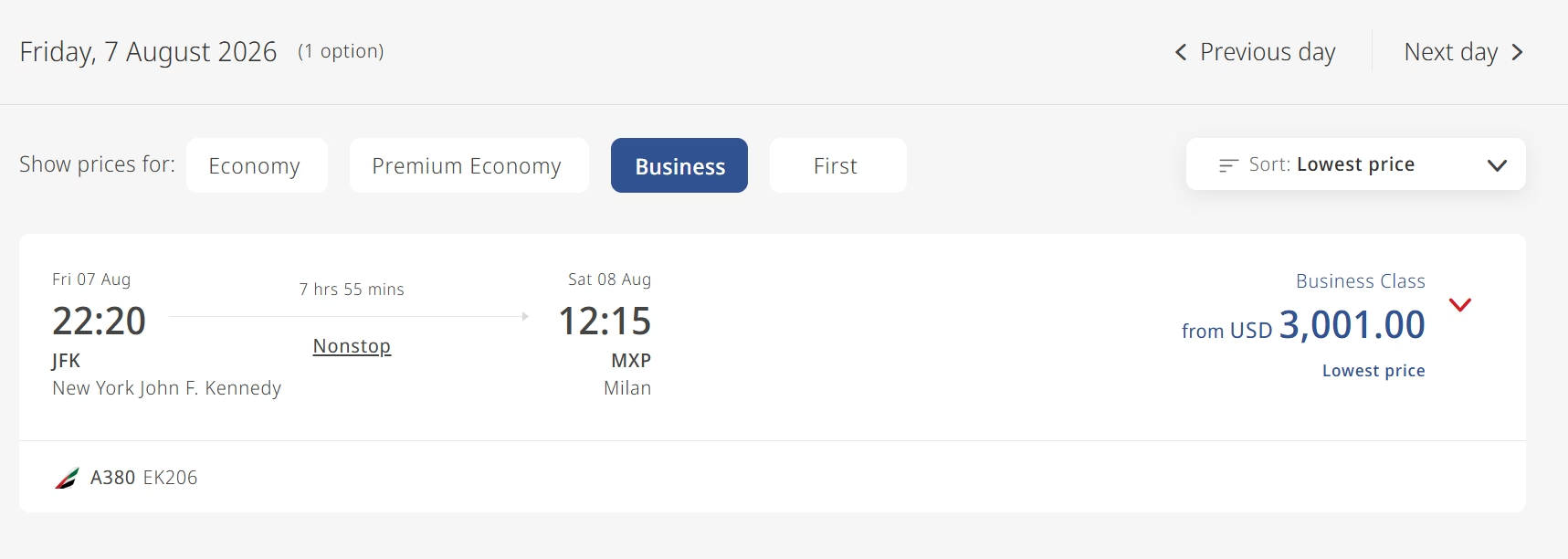

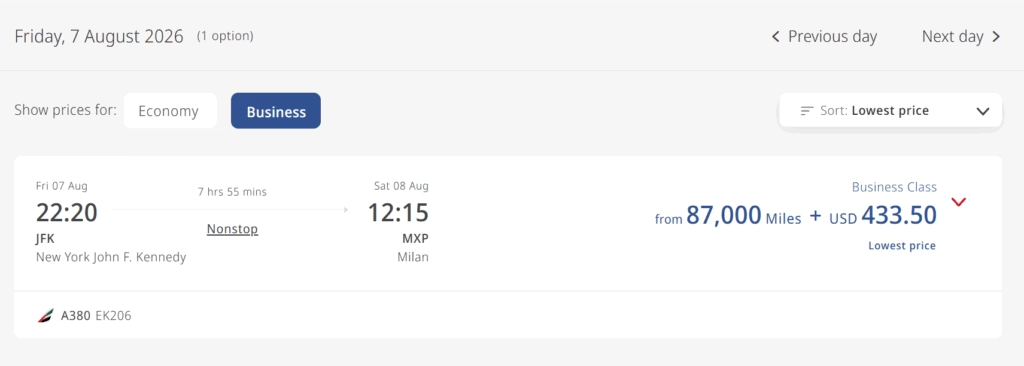

🛫 Example: Using Points for an Emirates Luxury Upper-Class Flight

Emirates Business Class (JFK → Milan)

One-way lie-flat business class seat in August 2026

- AmEx Portal: 310,100 points or $3,101.00

- Emirates cash price: $3,001.00

- Transfer Amex points to Emirates: 87,000 Skywards Miles + $433.50

→ Savings: nearly 223,100 points for the same seat!

Option 1: American Express Travel Portal

Option 2: Emirates cash price

THE BEST OPTION: Transfer Amex Membership Rewards to Emirates and book with points

Want to check this out on Emirates? Search here by clicking “Classic Rewards”.

⚠️ AmEx and Citi → Emirates is no longer 1:1, so consider transfer bonuses or alternate partners when available (Capital One and Bilt still transfer to Emirates at 1:1).

✈️ Key Differences Between Booking Flights: Transfer to Airline vs. Travel Portal

(Scroll for full table if some columns are hidden.)

| Feature | Transferring Points to an Airline Partner | Booking Through a Bank Travel Portal |

|---|---|---|

| How Pricing Works | Follows award charts or dynamic award pricing, which can unlock outsized value (especially for premium cabins). | Flight cost in points is tied to the cash price — usually 1.25–1.5¢ per point depending on your card. |

| Taxes & Fees | You’ll still pay government taxes and airline fees separately — $100–$300+ is typical, though some carriers and routes can exceed $500 in premium cabins. | Best for premium travel (lie-flat seats, international business class). |

| Best For | Business and first-class tickets, long-haul flights, or routes where cash prices are high. | Economy flights, budget airlines, or last-minute bookings when prices are low. |

| Flexibility | Award tickets usually don’t earn miles or elite credit. Change and cancellation rules depend on the airline’s policy. | Treated like a cash ticket, so you can earn miles and elite credit. Flexibility depends on the fare type you choose. |

| Booking Ease | Award tickets usually don’t earn miles or elite credit. Change and cancellation rules depend on the airline’s policy. | Book directly in your bank’s travel portal (like Expedia). However, any changes, delays, or cancellations must go through the portal’s customer service, not the airline. |

| When It Shines | Best for premium travel (lie-flat seats, international business class). | Best for simple, low-cost economy trips or flexible cash-style bookings. |

💡 Tip:

Transferring points gives you access to hidden award deals and better redemption value, but it requires more strategy and planning.

If you prefer one-stop simplicity (and don’t mind paying a bit more in points), the travel portal is an easier option.

Info Box: Why You Still Pay Taxes and Fees

Even when you use points, airlines must collect mandatory government taxes, airport fees, and fuel surcharges.

✈️ Example:

U.S. flights: about $5.60 each way

Transatlantic or long-haul: $100–$300+, depending on the carrier

💡 Some programs like United MileagePlus or Aeroplan keep fees low, while others (like British Airways Avios or Emirates Skywards) may charge higher surcharges.

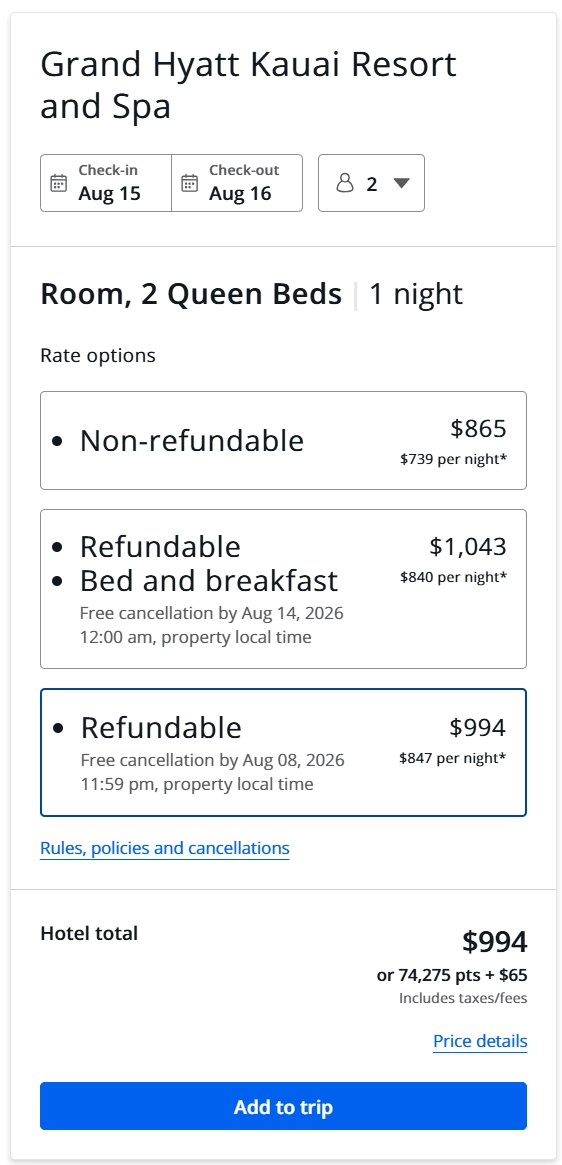

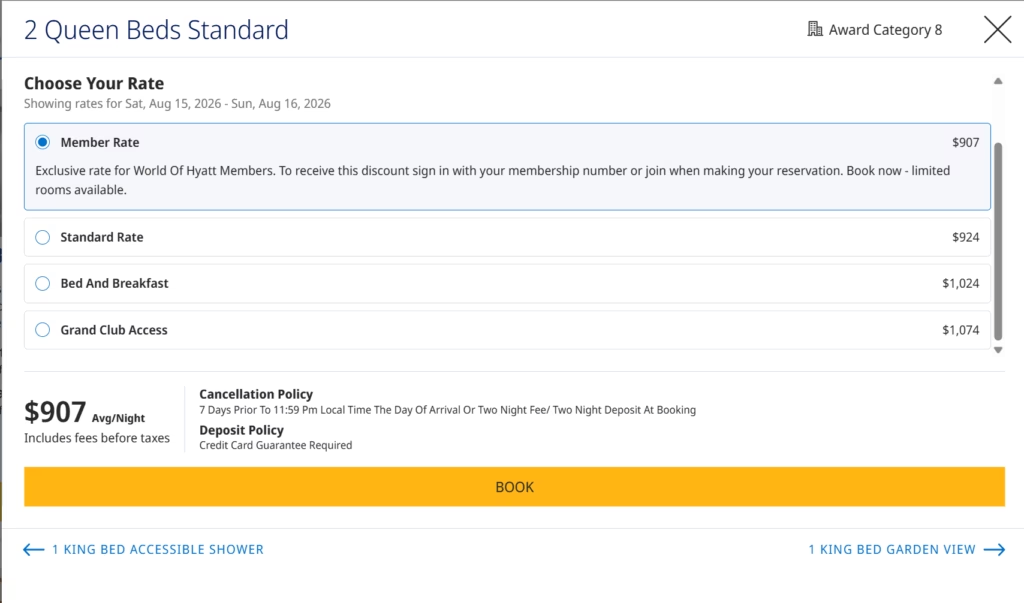

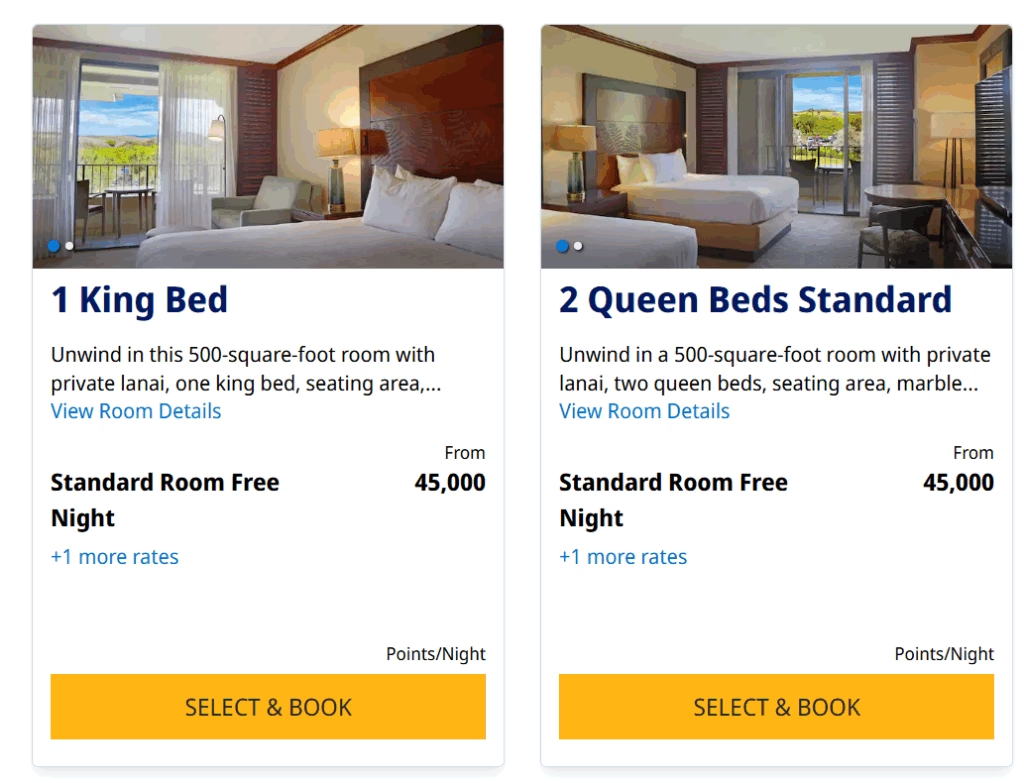

💸 Example: Using Points for a Hyatt Resort Stay

Grand Hyatt Kauai – one night standard room:

- Chase Travel Portal: ~74,000 points or $994/night

- Hyatt cash price: $907/night

- Transfer to Hyatt: 45,000 points

💡 Booking through the portal costs about 65% more points than transferring to Hyatt for the same stay.

⚠️ The Chase Travel Portal shows both the base nightly rate and the final total with taxes and fees. Always compare final totals across sites for an apples-to-apples decision.

Option 1: Chase Travel Portal

The Chase Travel Portal shows the base nightly rate and the final total with taxes and fees. Always compare final totals across sites.

Option 2: Hyatt cash price

THE BEST OPTION: Transfer Chase Ultimate Rewards points to Hyatt and book with points

See how much your favorite Hyatt property would be in points here.

🧳 Key Differences Between Booking Methods

(Scroll for full table if some columns are hidden.)

| Feature | Booking Direct with Hyatt (Using Points) | Booking via Chase Travel Portal |

|---|---|---|

| Point Cost | Usually fewer points (fixed award chart) | Often higher point total since price follows cash value |

| Taxes & Fees | None – points cover full stay | Taxes and fees often added separately |

| Cancellation | Typically full refund if canceled ≥48 hours before, but check cancellation policy for each property before booking. | Flexible options available, but higher point cost for refundable rates. |

| Perks & Breakfast | Not included unless you have elite status or book a premium room | Perks depend on rate type; breakfast rarely included |

| Flexibility | Great for predictable redemptions | Good for last-minute bookings or non-chain stays |

💡 Tip: Always compare both totals before booking. When hotel prices spike, transferring to Hyatt often gives much better value.

How to Transfer Credit Card Points

Each credit card program lets you transfer points to its travel partners right from your online account in the same place you go to check transactions, pay your bill, and manage your card. Every program looks a little different, but you’ll always want to find the section labeled something like “Rewards,” “Points,” or “Travel”.

Useful Transfer Links for Rewards Programs

American Express Membership Rewards

🔁 Transfer Ratios & Bonuses

Most transfers are 1:1, but some vary (e.g., AmEx → Hilton = 1:2).

Keep an eye out for transfer bonuses, like “20% bonus to Aeroplan,” for extra value.

🏅 Best Transfer Partners for Beginners

Hyatt (via Chase) – unbeatable hotel redemptions

United (via Chase/Bilt) – simple award search

Air Canada Aeroplan and Virgin Atlantic – multiple transfer partners and redemption offers via partners

Flying Blue (via Chase, AmEx, Capital One, Citi, Wells Fargo, Bilt) – great Europe flights

📋 Quick Tips: Best Way to Use Credit Card Points for Travel

- Earn flexible points (not brand-locked ones)

- Compare cash vs. points value before booking

- Transfer points only when ready

- Use transfer bonuses when available

- Redeem for international or premium travel for best value

Packing It Up!

Transferable points have revolutionized the way my family travels. They provide the freedom to choose, the potential for more travel, and the ability to maximize every point earned. Furthermore, by understanding how these programs work, you can turn everyday spending into incredible travel experiences.

So, whether you’re planning a dream vacation or just want to stretch your travel budget further, transferable points are your key to unlocking endless possibilities.

FAQs

How do I use my credit card points for travel if my airline isn’t a partner?

You can still book flights using partner airlines within alliances like SkyTeam, Star Alliance, or oneworld.

For example:

Use Flying Blue (Air France–KLM) to book Delta or Korean Air routes.

💡 Tip: Check which alliance your preferred airline belongs to — you can often book those flights right on a partner’s website using transferred points.

Use Virgin Atlantic points to book Delta flights.

Are there fees to transfer points?

Usually no — most programs let you transfer for free.

The main exception is American Express, which charges a tiny excise tax fee of $0.0006 per point when transferring to U.S. airlines (like Delta), capped at $99 per transfer.

Example: 10,000 AmEx points → Delta = $6 transfer fee.

No fee applies for international airlines or hotel partners.

When should I use points vs. cash?

Use points when flight or hotel prices are high — especially if you’re getting at least 1.5¢ or more per point in value.

Use cash when prices are low or when you want to earn miles and elite status.

💡 Tip: Don’t obsess over “perfect” value — the best redemption is the one that fits your trip and budget comfortably.

Is Booking Flights with Miles Different from Booking with Cash?

Yes. When booking with miles, award seat availability matters more than price, and you’ll usually need to be flexible with routes or dates.

For example, I booked an Emirates flight from JFK to Milan and added a separate positioning flight from my home airport to JFK to make it work.

💡 Tip: Think of booking with miles like a puzzle — a little flexibility can unlock business-class flights for economy-level points.