Stack Smart: No-Fee Cards + Portals = Transferable Travel Points

Looking to earn travel rewards without paying hefty credit card fees? These perfect pairings combine no-annual-fee cards with shopping portals and programs that earn transferable points — the kind you can use for free flights, hotels, and more. Whether you’re new to points or just want to maximize what you already spend, these strategies work great even on a small budget.

Still hanging out in Step 2 of the Points and Miles Mindset? That “wait, I can do this without paying an annual fee?” stage? You’re in the right place — let’s stack some rewards.

No-Fee Travel Cards That Work With Portals to Earn More Than Just Base Points

Capital One VentureOne + Capital One Exclusive Offers: Earn Transferable Points with No Annual Fee

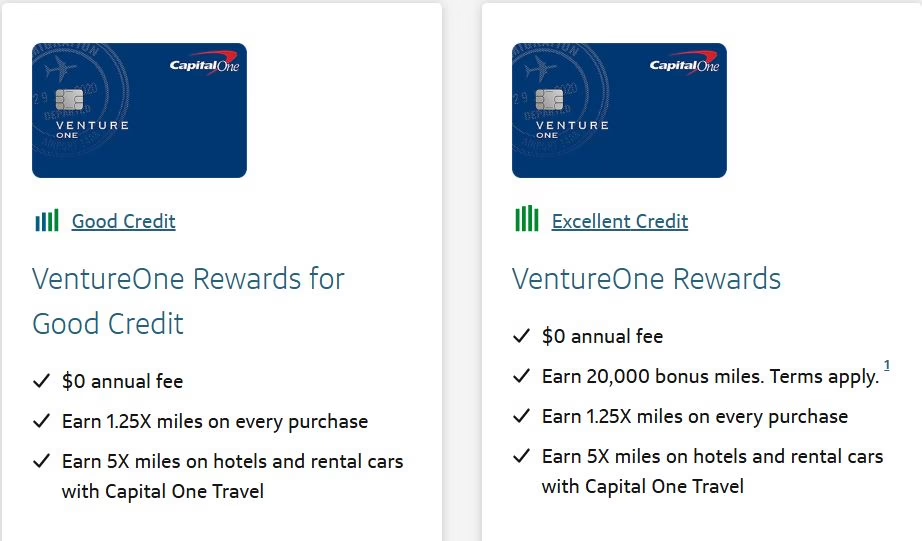

Capital One offers two no-annual-fee versions of the VentureOne Rewards card:

- VentureOne Rewards for Good Credit

- VentureOne Rewards Credit Card (for excellent credit)

For the purpose of earning transferable Capital One miles through a shopping portal, either version works — so choose the one that fits your credit profile best.

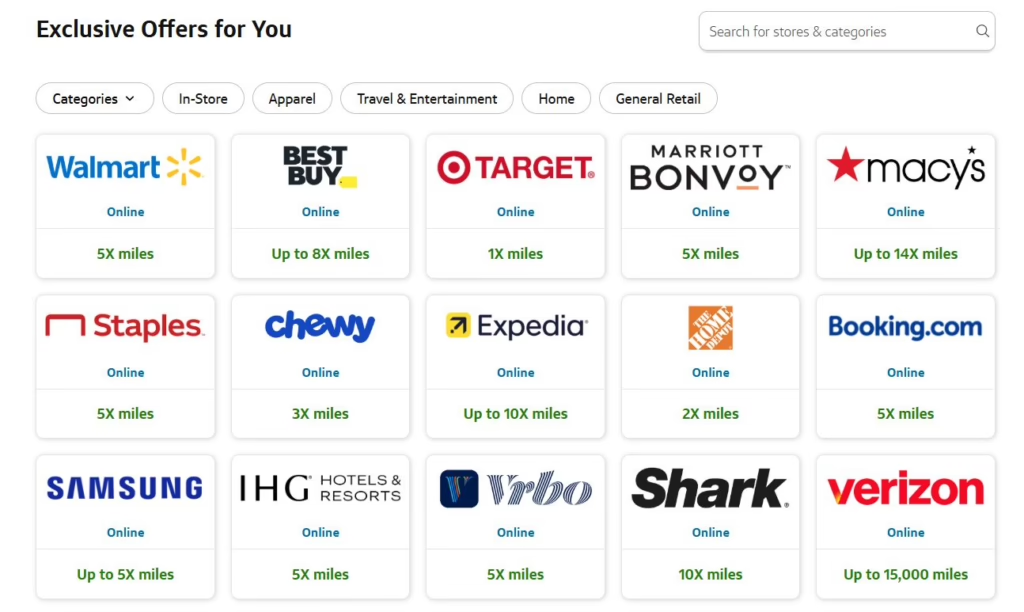

When you log into your Capital One credit card account (via the website or app), you’ll find a section called “Offers for You.” Think of this as Capital One’s built-in shopping portal. While many Capital One cards display these offers as cashback, Venture and VentureOne cards can earn extra Capital One miles instead.

🛑 Important: This is not the same as the Capital One Shopping browser extension, which earns cashback that can only be redeemed for gift cards.

✅ We’re talking here about transferable Capital One miles — the kind that can be moved to airline and hotel partners for travel.

You’ll find rotating offers for travel, pets, retail, and more. When you’re ready to make a purchase:

- Log in to your Capital One account.

- Click on the offer for the retailer you plan to shop with.

- Shop as usual through the link that opens.

- Use any card you want at checkout — although you can, of course, use your VentureOne card to stack even more miles.

Let’s say you see an offer for 14X miles at Macy’s. If you spend $100 using a VentureOne card (which earns 1.25X on everything), here’s what you get:

- 125 miles from the regular 1.25X base earn rate on your card

- 1,400 miles from the shopping offer (14X on $100)

= 1,525 Capital One Miles total for a $100 purchase

If you were going to make that purchase anyway, you’ve just earned free transferable points — all without paying an annual fee.

How to use Capital One Miles

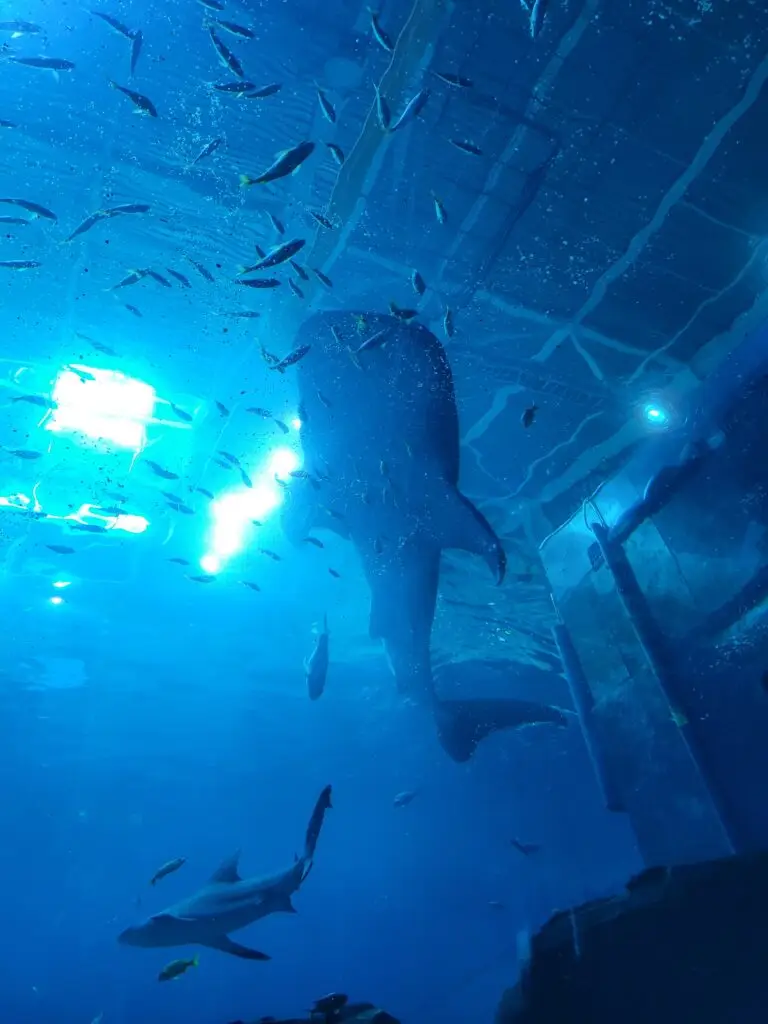

My favorite way to use Capital One miles is on International flights and they’ve taken me far 😉

You can transfer to partners including Air Canada Aeroplan, Virgin Atlantic, British Airways, Flying Blue, Turkish (and more). They also transfer to hotels such as Accor, Wyndham and Choice Privileges.

Amex Blue Business Plus + Rakuten: Stack Rewards Seamlessly

One of the most underrated power pairs for earning transferable points is the Amex Blue Business Plus® Credit Card and Rakuten.

The Amex Blue Business Plus earns 2X Membership Rewards® points up to $50,000 in purchases each year — no categories to track, no annual fee, and yes, those points are fully transferable to Amex travel partners.

Now here’s where it gets better: when you link your Rakuten account to Amex (which is free and easy), you can start earning Membership Rewards instead of cash back on Rakuten purchases. To be eligible, your AmEx Card must earn American Express Membership Rewards points. That means co-branded cards like any Hilton or Delta cards are not eligible. Cards like the American Express Green, Gold, or Platinum personal or business cards are eligible, but the Blue Business Plus card is the only (current) no annual fee card that earns Membership Rewards points. This is also a great card to hold forever in case you decide to cancel other higher annual fee cards in the future. This card can both “hold” your Membership Rewards points and act as your conduit to earn Membership Rewards through Rakuten.

Important to Know: You must have an eligible Membership Rewards card to link to Rakuten and this is where your points will be deposited. You ARE NOT REQUIRED to use that card for your Rakuten portal purchases which earn those points.

Also Important to Know: You are not required to have a formal business entity to apply. Sole Proprietors and freelancers can apply with their ssn and estimated income.

Rakuten: $1 Cash back= 100 Membership Rewards Points

Here’s how it works:

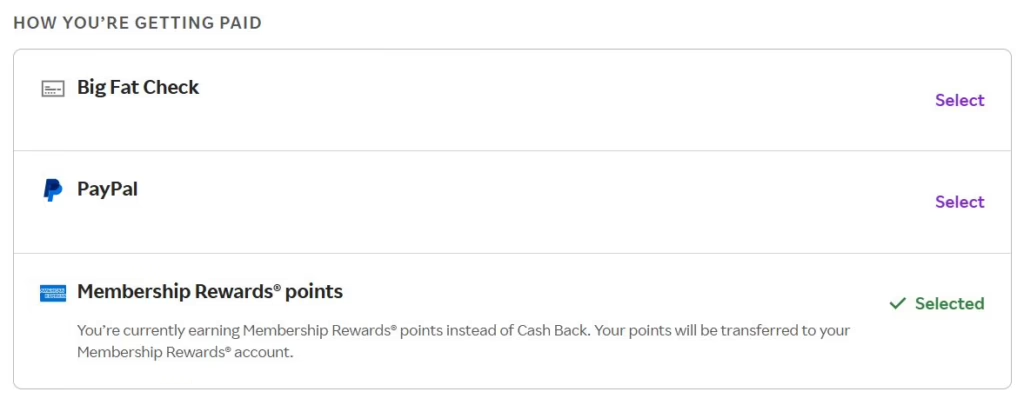

Sign up for a Rakuten account and link it to your Amex Membership Rewards account.

- In Rakuten, go to Account Settings and “How You’re Getting Paid”; Select Membership Rewards points and sign in to your AmEx account to link it to Rakuten.

- Activate a shopping offer through Rakuten (either online or via the app).

- Shop through Rakuten’s link.

- Pay with any card and you will earn extra AmEx Membership Rewards for your purchase

For example, if Rakuten is offering 10% back (or 10X Membership Rewards points) at a retailer and you spend $100, you’ll earn:

- Rakuten (10X): 1,000 AmEx Membership Rewards points

- AmEx Blue Business Plus (which earns 2X on all purchases): 200 AmEx Membership Rewards (OR you will earn whatever rewards you get from the specific card you used)- this will be shown on your credit card account, not Rakuten.

Total earned= 1,200 Membership Rewards points for one $100 transaction.

All for something I have to buy anyway. This duo is one of the most effortless ways to earn free, transferable Amex points — no fee, no complicated steps, just smart stacking.

Important to know: Rakuten only transfers your Membership Rewards every 3 months so you will not get them right away, but you will see them in your Rakuten account.

How to use American Express Membership Rewards Points

American Express has some fantastic partners including many of the same ones Capital One has. In addition, they are partners of Hilton, Marriott, and Delta.

Bilt Without (or With) the Card: Earn Points Through Everyday Spending

You might know Bilt as the card that earns points on rent — but there’s more than one way to earn Bilt Points, and you don’t even need the Bilt Mastercard to get started.

Through the free Bilt Rewards app, you can link your existing credit cards and earn Bilt points automatically when you shop at select partners in three key categories:

- Neighborhood Dining – Earn points at participating restaurants just by using a linked card. These used to be limited to really big cities, but now, there are more and more eligible restaurants every day!

- Walgreens – Qualifying purchases at Walgreens (in-store or online) earn points.

- Fitness Classes – Earn points at partner studios like SoulCycle, Rumble, and Y7.

Here’s how to earn without the card:

- Download the Bilt Rewards app.

- Create a free account and link your credit or debit cards.

- Browse the “Neighborhood” tab to find eligible spots near you.

- Spend as usual with a linked card — Bilt tracks it and awards the points.

That’s it. You can be earning transferable Bilt Points on purchases you’re already making — with any card, and no annual fee.

Want to boost your earning potential? Consider the Bilt Mastercard®.

It also has no annual fee, and it’s the only credit card that earns points on rent without a fee — something no other card offers. You’ll also earn:

- 3X points on dining

- 2X points on travel

- 1X on rent and everything else

If you’re a renter, this card is a game-changer. And who knows — maybe someday Bilt will open the door to mortgage payments with rewards too. That would be huge!

➡ ️ Pro Tip: Bilt categories (excluding rent) earn double points on the first of each month — so dining jumps from 3X to 6X, travel from 2X to 4X, and so on. If you have the flexibility, plan your spend accordingly.

How to use Bilt points

Bilt has one of the most impressive travel partner lists out there — including Hyatt, United, Alaska, Southwest, and more.

Bonus Stackers: Amex Offers & Chase Offers

Once you’ve set up your perfect portal pairing, there’s one more way to supercharge your earnings — and it’s hiding right in plain sight: Amex Offers and Chase Offers.

These are targeted promotions you can activate right from your credit card account. They’re typically cash-back or statement credits (and occasionally points or miles) when you spend a certain amount at specific retailers — but if you’re strategic, you can stack them with Rakuten, Bilt, or Capital One shopping offers to double dip on rewards.

Here’s how to use them:

- Amex Offers:

Log in to your American Express account and scroll to the “Amex Offers & Benefits” section (they are card-specific). Browse or search for deals and click “Add to Card.” When you use that Amex card to make a qualifying purchase, you’ll get the reward automatically to your card account. - Chase Offers:

Log in to your Chase account or app, go to your card, and tap on “Chase Offers.” Add any offer that looks good, and be sure to use that same Chase card at checkout. You will get those benefits back to your card.

Example 1: A Kiwi Co. stem project box or subscription. On many of my Chase cards, Kiwi Co is offering 10% cash back.

I would add that offer to my Chase card and go to the Capital One credit card offers page. Capital one is currently offering 9% when purchases are made through their link. I click on the link and make the purchase with my Chase credit card.

If my purchase is $100

- Chase will give me $10 back as a statement credit (10% offer)

- Chase will give me 100 Chase Ultimate Rewards (the card offers 1X on spend)

- Capital One will give me 900 Capital One miles (9X) for purchasing through their link.

Example 2: I need new tires. On my AmEx Blue Business Plus card, there is an offer for 10% back at Tire Agent. On the Tire Agent offer, I would select “Add to Card”. Then, I would go to Rakuten, where Tire Agent offers 4% back. I would click the Tire Agent link in Rakuten, make the purchase with my Amex Blue Business card, then do a happy dance.

AmEx account:

Rakuten:

If my purchase is $500:

- AmEx will give me $50 back to my card as a statement credit (10% of my purchase)

- AmEx will also give me 1,000 Membership Rewards points because this specific card earns 2X on everything (500 X 2)

- Rakuten will give me 2,000 AmEx Membership Rewards points (4X)

That’s a lot of value — and you didn’t have to spend a cent more than usual. These offers (both on cards and in shopping portals) are rotating and change over time. Card offers are often targeted so you may not get the same offers as someone else. Always check to see what offers may be of the most value to you! The key is stacking “add to card” offers with shopping portal-like offers.

Packing It Up

These no-fee combos are proof that you don’t need premium cards or big spending to start earning serious travel rewards. By stacking shopping portals, linked programs, and the right cards, you can build transferable points with everyday purchases — no pressure, just progress.

Header image via Samuel Clara on Unsplash